Bybit Exchange, new panel Order Placing Strategy and improvements in DOM Trader. The most interesting of February.

Navigation

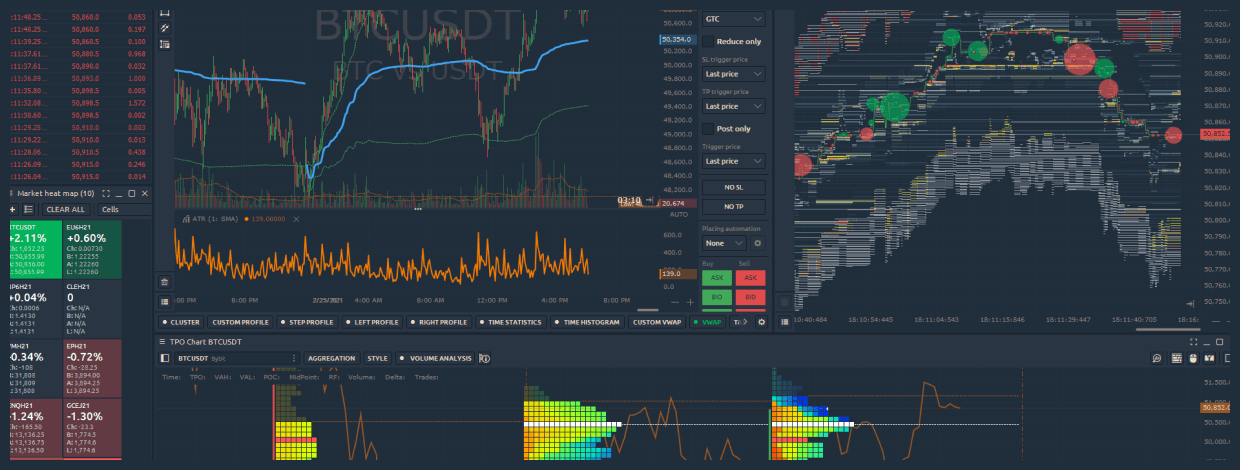

February was an incredible month in terms of updates and new features. But first things first. During the month we put a lot of emphasis on the DOM Trader panel, made changes to our existing crypto connections — FTX, Binance — and added the long-awaited connection to Bybit exchange. Let's start with the headliner of this digest.

Added trading connection to Bybit derivative crypto exchange

Introducing a new integration with Bybit cryptocurrency derivatives exchange which offers perpetual contracts with up to 100 x leverage. Despite the fact that the exchange was launched in 2018, it has steadily ranked among the top 5 crypto exchanges by daily trading volumes (according to skew website, data from February 2021).

As with the rest of the already connected crypto exchanges in the Quantower platform, you can connect with two modes:

- Info Mode — free and quick way to view charts and other data for cryptocurrencies on the Bybit exchange without the need to enter keys

- Trading Mode — for trading on the Bybit exchange in demo or real mode. API Keys are required. Below you will show how to get keys for trading.

If you don't have a trading account yet, you need to create one on Bybit official website. We've also prepared a detailed guide on how to open a trading account on Bybit exchange and connect it to Quantower.

Once you connect to Bybit, you can use the platform's basic functionality for free — Chart trading, a wide list of indicators and drawings, DOM Trader panel, Market Heatmap etc. For advanced analysis, there are paid packages with access to volume analysis tools — Volume Profiles, VWAP, Cluster Chart, TPO Chart, DOM Surface and advanced chart types like Heikin Ashi, Renko, Kagi, Range bars.

Market Replay panel allows testing trading strategy on the past history. Trading Simulator panel allows you to trade on real-time data without the risk of losing money.

Visual and Trading improvements in DOM Trader panel

By the numerous requests of our users, we have added a huge number of visual settings for all columns, which we put in a separate category. Here you can choose the background color, set any font, as well as the alignment of values and histograms for volume profiles.

We have added Highlighting of Imbalance and Bid/Ask sizes to visually display the values specified in the setting. This allows traders to see large levels easily, as well as assess the predominance of buyers or sellers.

As for trading improvements, we have changed the mechanism for placing and managing orders. To place a new limit order, just click on the Ask or Bid column, and further modification or cancellation is done through the Buy/Sell columns. If you need to place a Stop order, just hold down the Shift key while placing the order.

Besides, we've added a setting called Refresh rate. It allows controlling the rate (ms) of market data updates. This determines how often the panel refresh changes in depth of market (depends on data provider). With a value of 1, all changes to the level2 data will be processed immediately. We recommend using value 100. Note, the smaller the value, the more system resources required.

Order Placing Strategy. New panel for advanced order types

New panel Order Placing Strategy can implement advanced trading algorithms such as splitting order by time or volume, Iceberg, local SL/TP, Trailing, etc. Two strategies are currently available - Scheduled, Time Split.

- Order placing strategy "Scheduled" will send your order on a specified day and time.

- Order placing strategy "Time Split" will divide the size of your order into equal parts and send them in a few steps according to specified Display Quantity and via selected time Interval.

Added Stop Loss and Take Profit orders for Binance Futures

Two important order types — Stop Loss and Take profit — automatically close the position when the price hits a specified level. The main goal of Stop Loss is to limit losses of the existing position. At the same time, Take Profit order, which closes the position with a predetermined profit level, should be automatically canceled.

In Quantower platform, users can set a Server-Side Stop Loss / Take Profit for Market orders. Thanks to this, traders can not worry about their open position in case of loss of Internet connection or other force majeure. Once you set SL/TP for your position, they will be placed on the Binance exchange side. If one of the orders is executed, the exchange will close the position with a market order. The position will be closed guaranteed.

Other useful improvements

-

Updated timeframe selector

Due to numerous (!) requests from our customers, we have updated the mechanism for selecting the timeframe and depth of the loaded history. Now, before choosing the desired timeframe, you can specify the required depth of the loaded history. In addition, when you add a specified timeframe to the list of favorites, the whole list is automatically sorted.

-

Added an account selection setting for FTX

Added the ability to select the main and sub-accounts. Due to the specifics of the exchange API, the speed of order processing was executed with a delay of up to 5 seconds, which led to a slippage of the order and incorrect opening of orders. For example, if you work only on the Main account, the processing of orders is much faster than when you connect to multiple accounts (Main + Sub-accounts).

-

Additional settings for Level2 indicator

Added highlighting of levels to the Level2 indicator that has a value greater than specified in the setting. Moreover, you can set any color for bids and offers levels.

Check your Quantower platform for updates and leave us a comment about what you liked or didn't like. If you don't have it yet, go to the download page and get the latest version. See you soon with more news!

Comments