Charts and Analytics

Volume analysis tools

Quantower provides the set of professional volume tools for analyzing the distribution of the trading volume at each price level, an imbalance between buyers & sellers

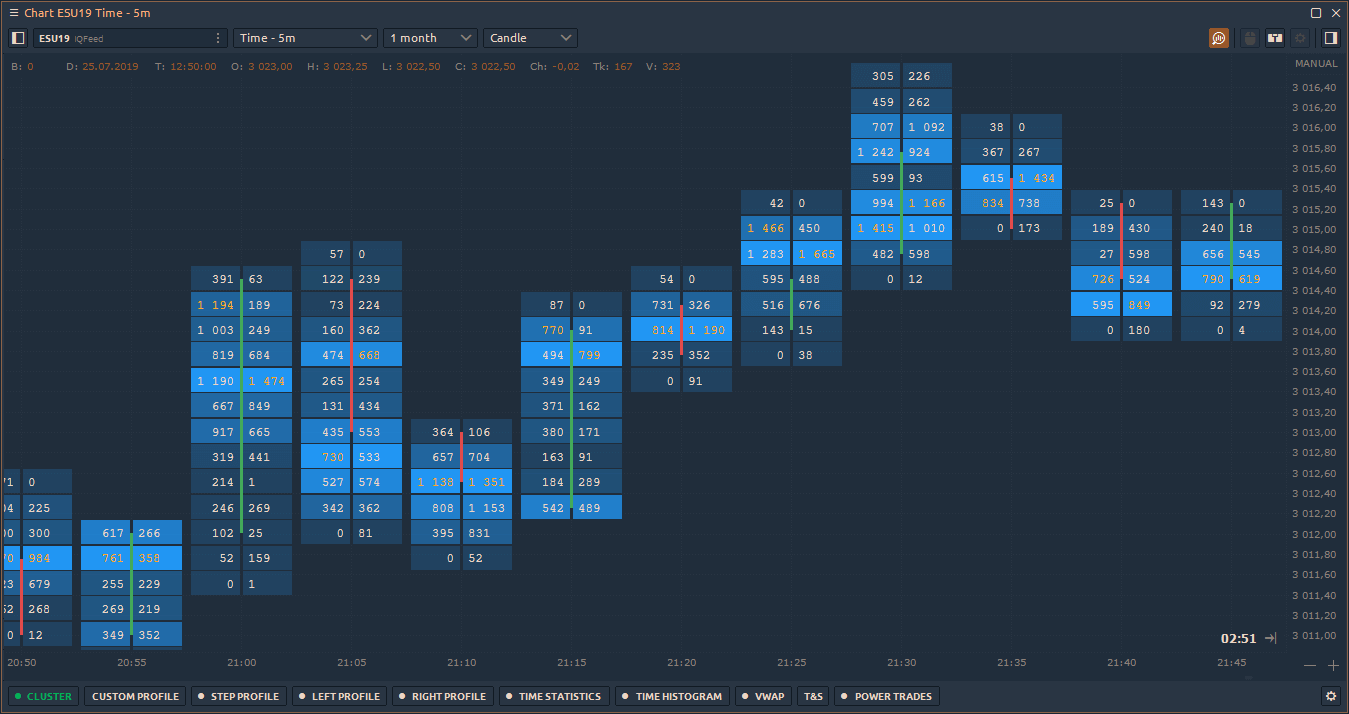

Cluster Chart

Gain full market insight using price, volume, time and order flow on a single chart

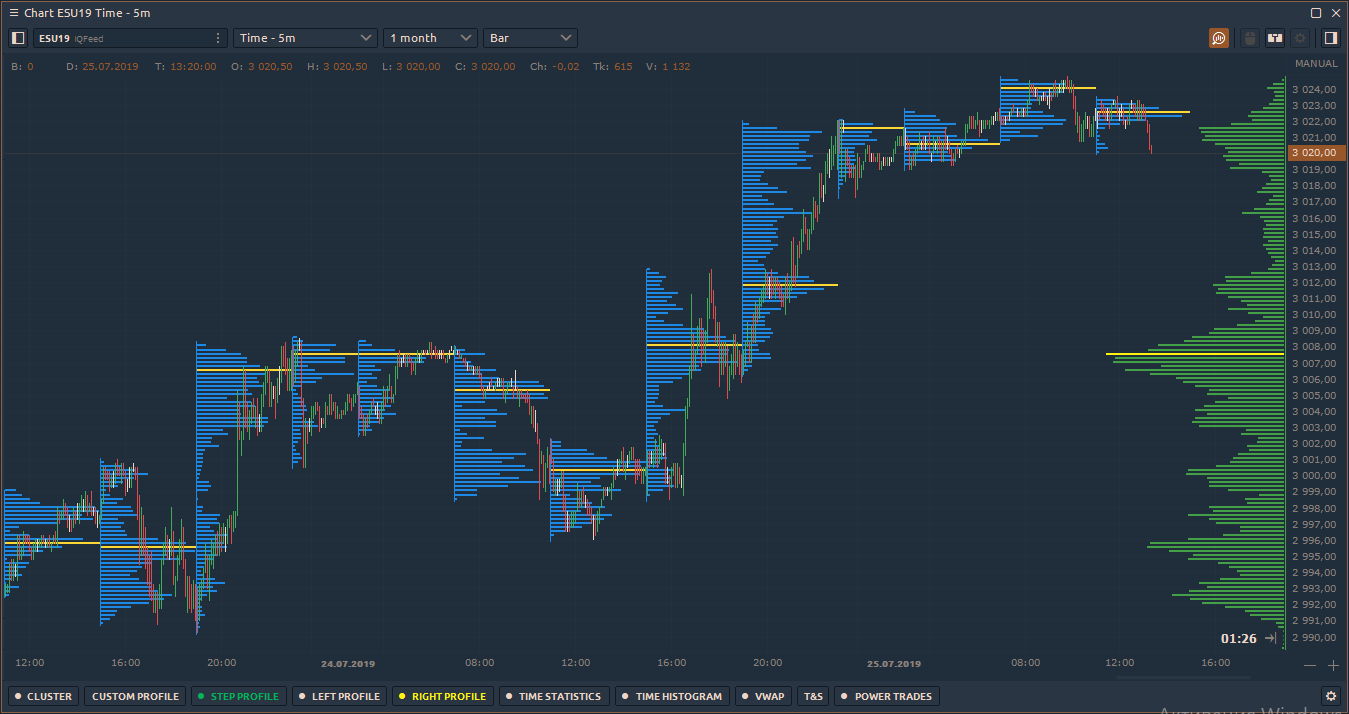

Volume profile

Add volume profile with various time periods, find our point of control and value area.

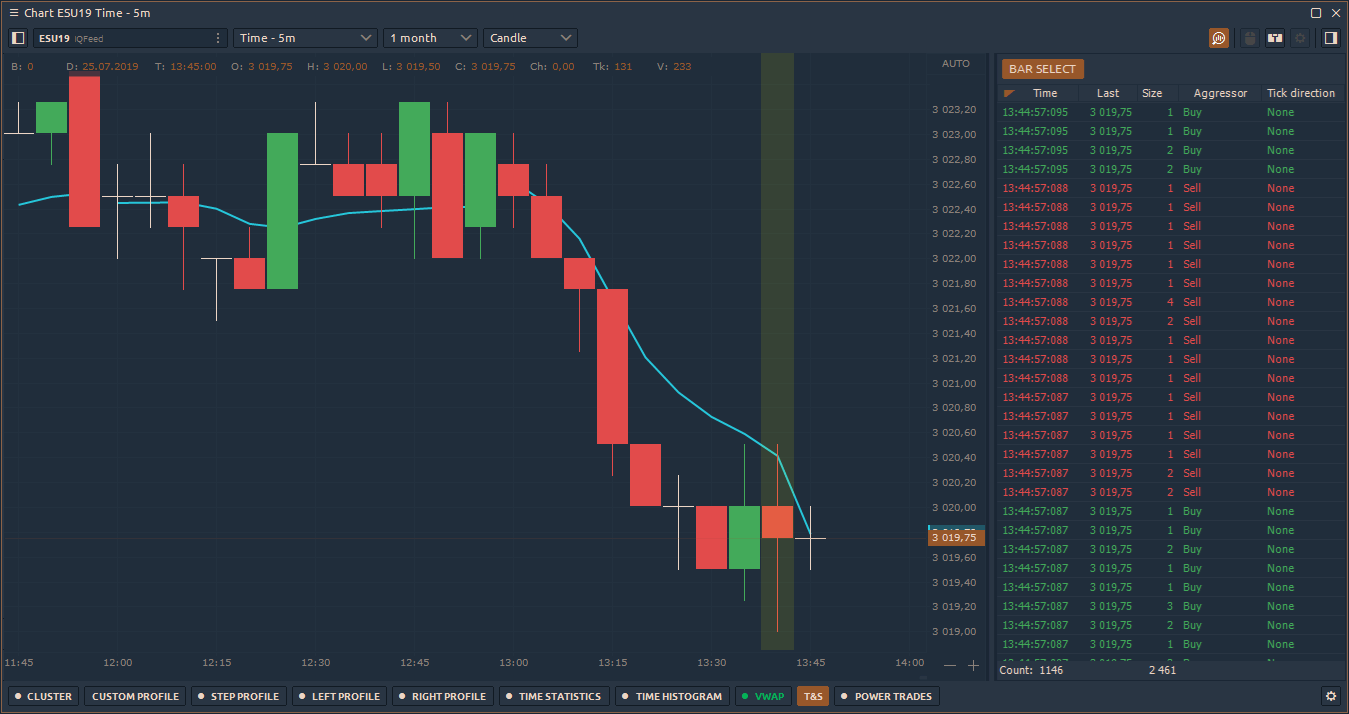

Historical Time & Sales

Check all previous trading activities on a selected candle with Historical Time & Sales

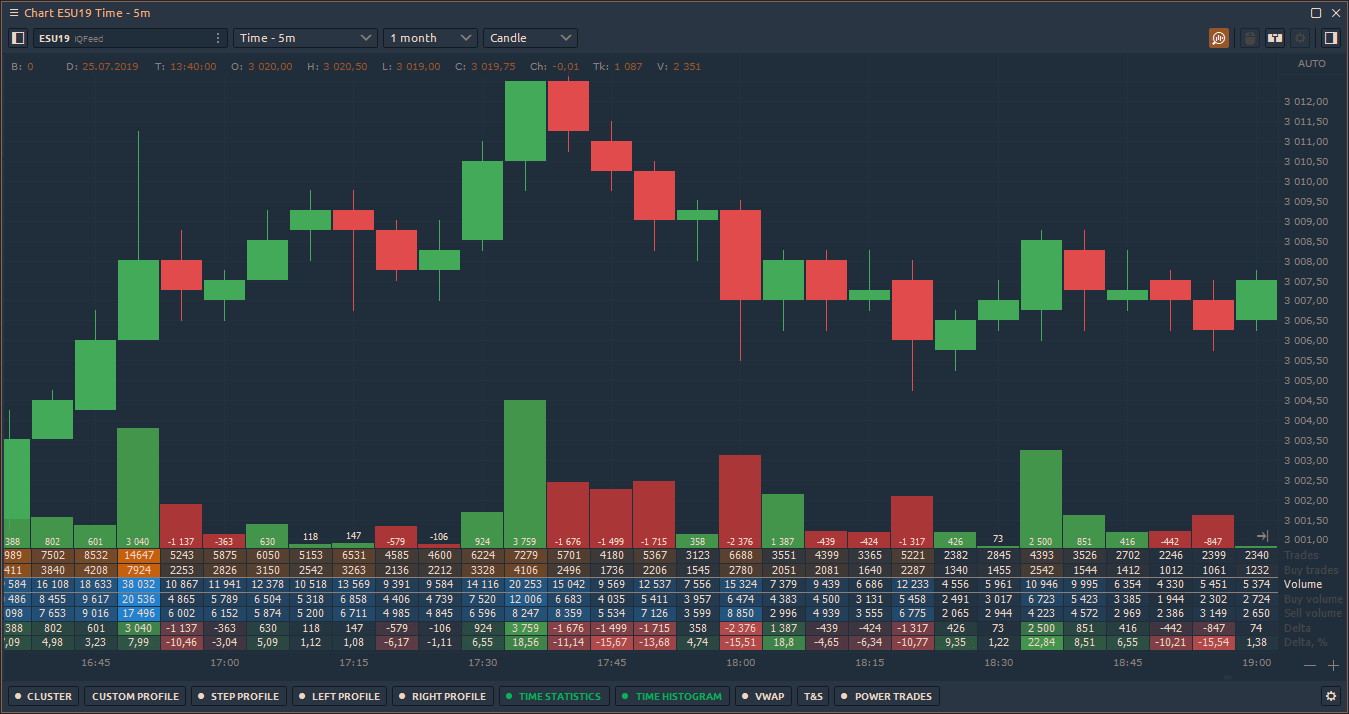

Time statistic & Histogram

Get detailed volume statistics for each bar — Delta, Volume, Number of Trades etc.

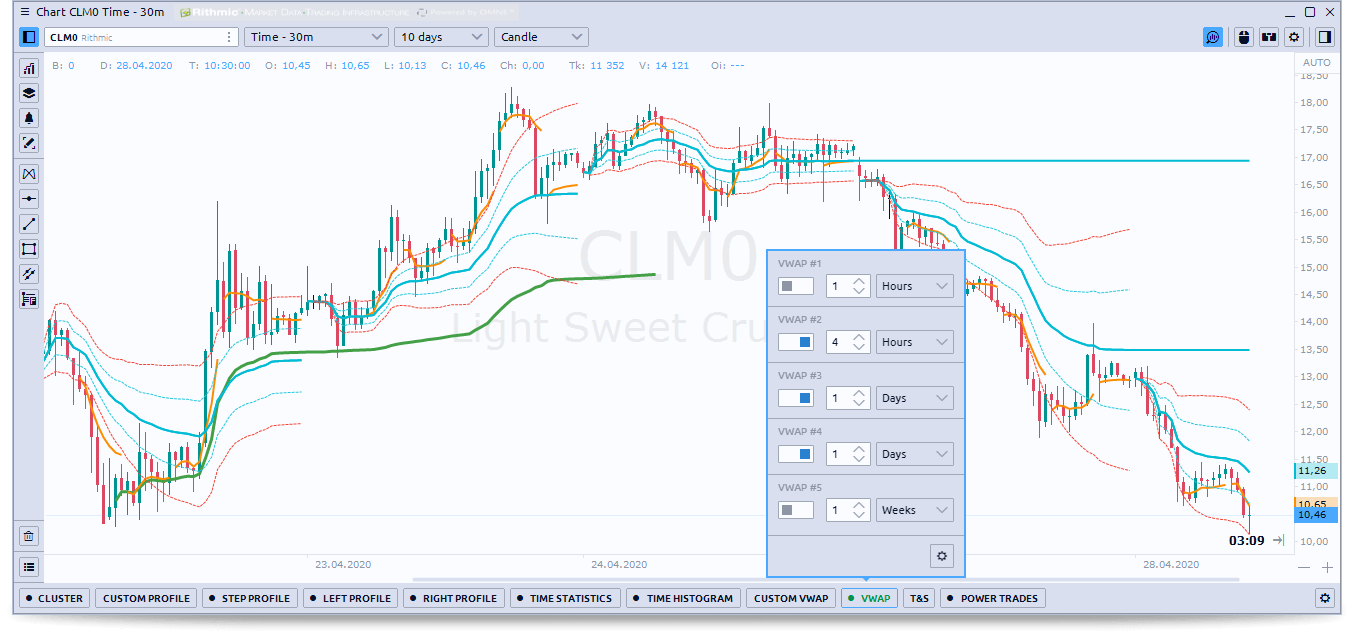

Volume weighted average price (VWAP)

Reveal a “benchmark” price for an asset for any period of the trading day or session. Average price is weighted by volume for evaluating the overpaying or underpaying of current price relative to the VWAP price

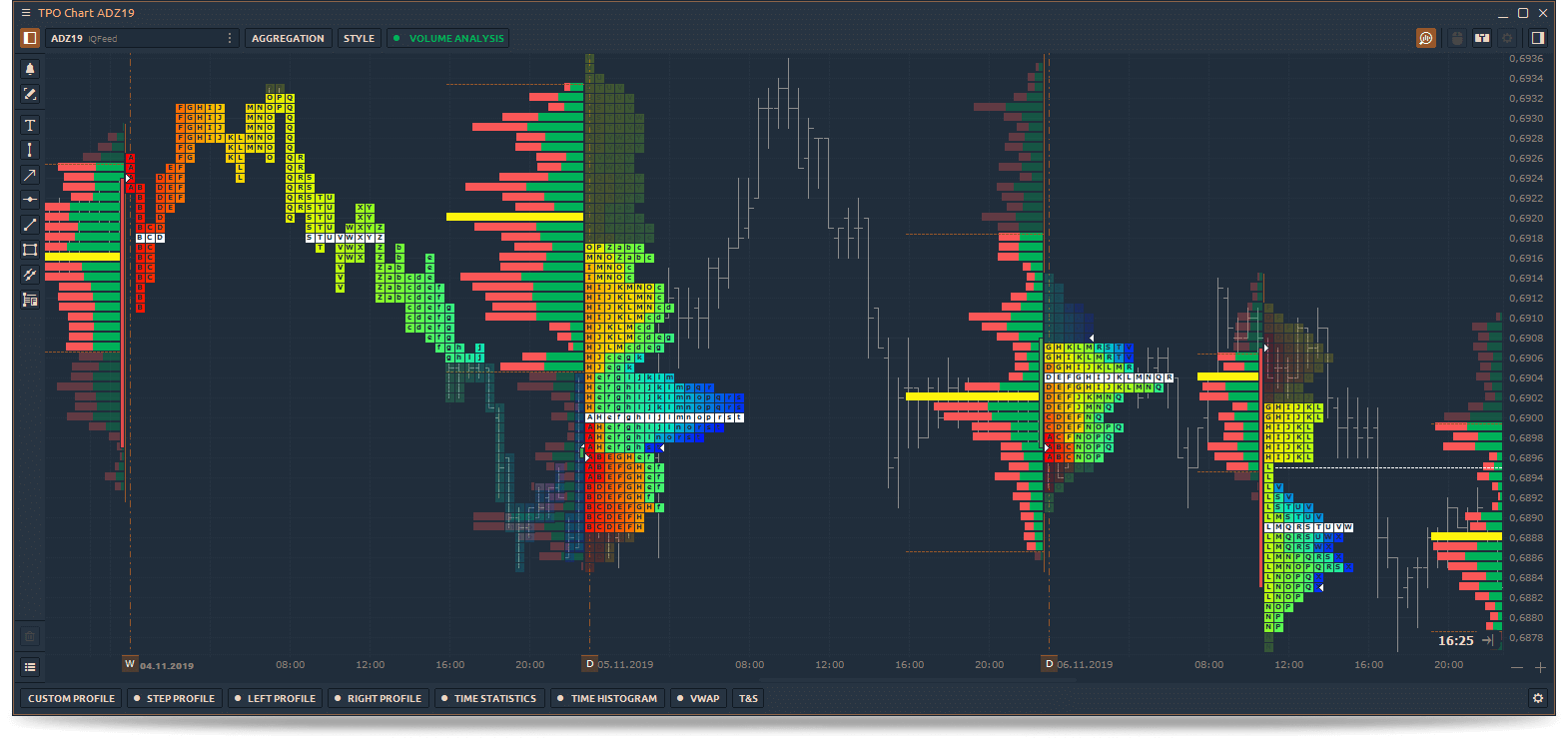

TPO Profile chart

Analyze the TPO Profile to understand the price distribution during the day or trading session

- Shows crucial support/resistance price levels

- Display TPO Point of Control, Value Area and Singles

- Split & Merge TPO Profiles for all-around analysis

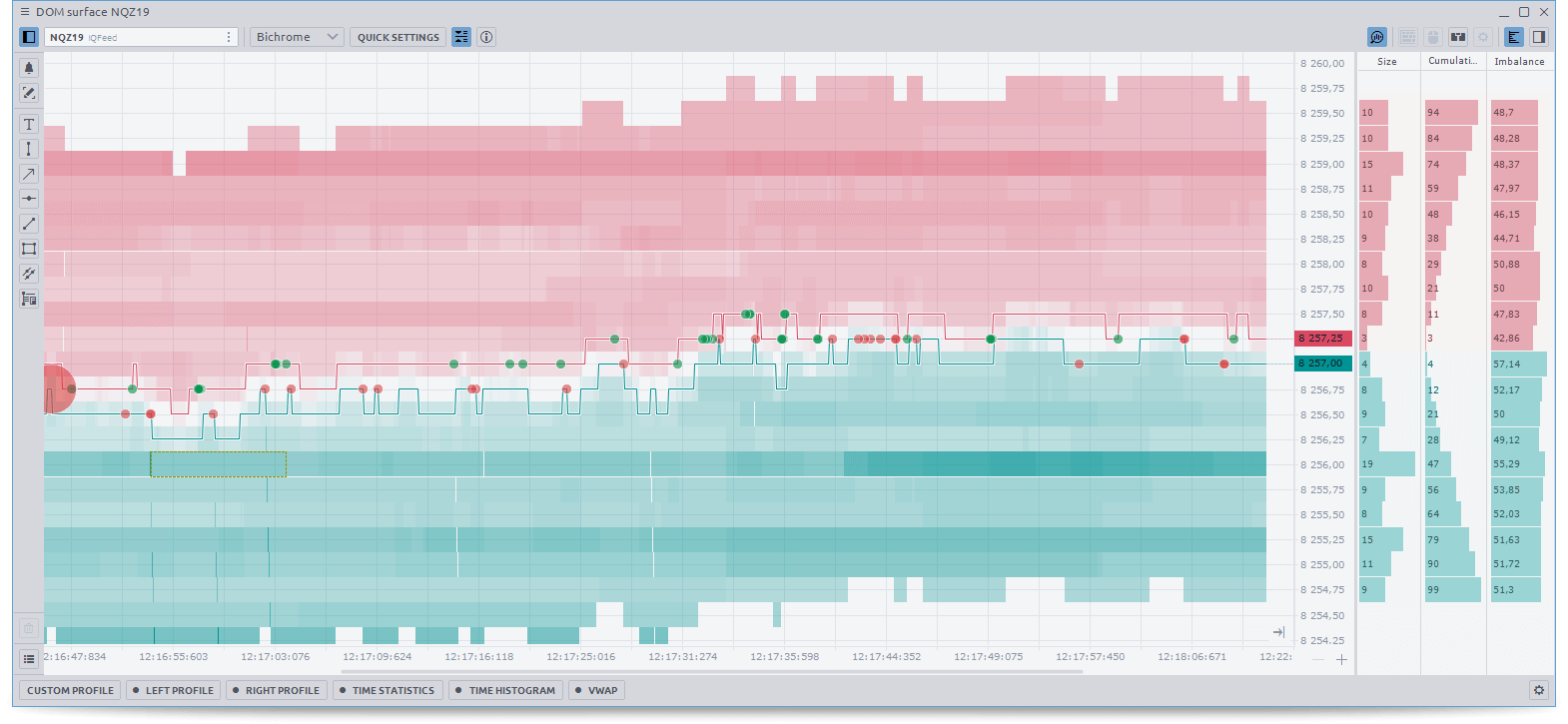

DOM Surface

Gain unique market insight by using the DOM Surface. Find the most reliable price levels with a huge amount of limit orders that can affect the price movement

- Analyze Cryptocurrencies, Futures, Stocks, ETFs

- Use Volume Analysis Tools directly on the order flow chart

- Set different numbers of DOM levels for a clear picture

- Heatmap mode tracks the liquidity change at each price level

Feels like the Quantower is what you are looking for?

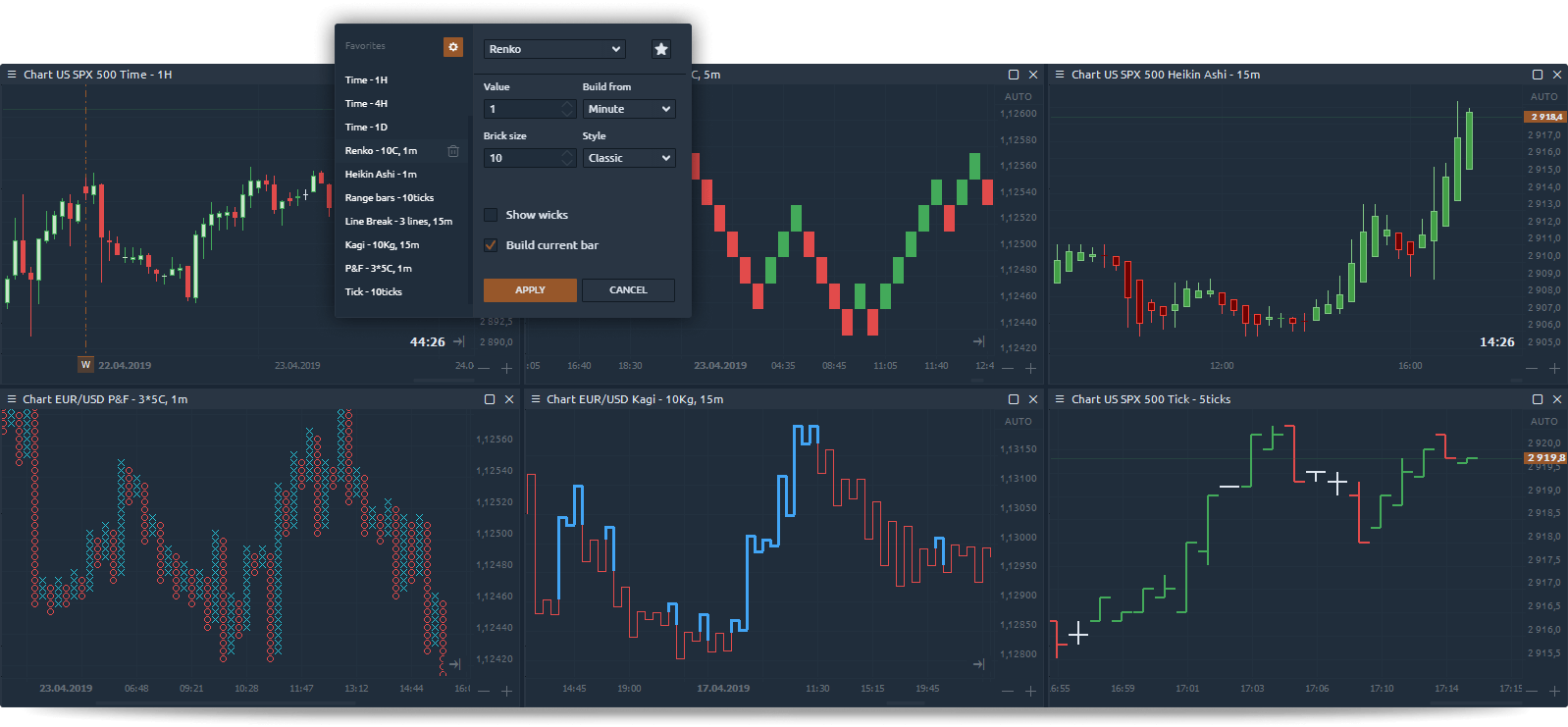

Chart types

Get a trading advantage in the market using professional charting tools. Analyze the market with our easy-to-use features and an extensive list of chart types:

- Kagi, Renko, Point & Figure, Line Break

- Time-based chart with custom time periods

- Heiken-Ashi, Tick chart, Range Bars

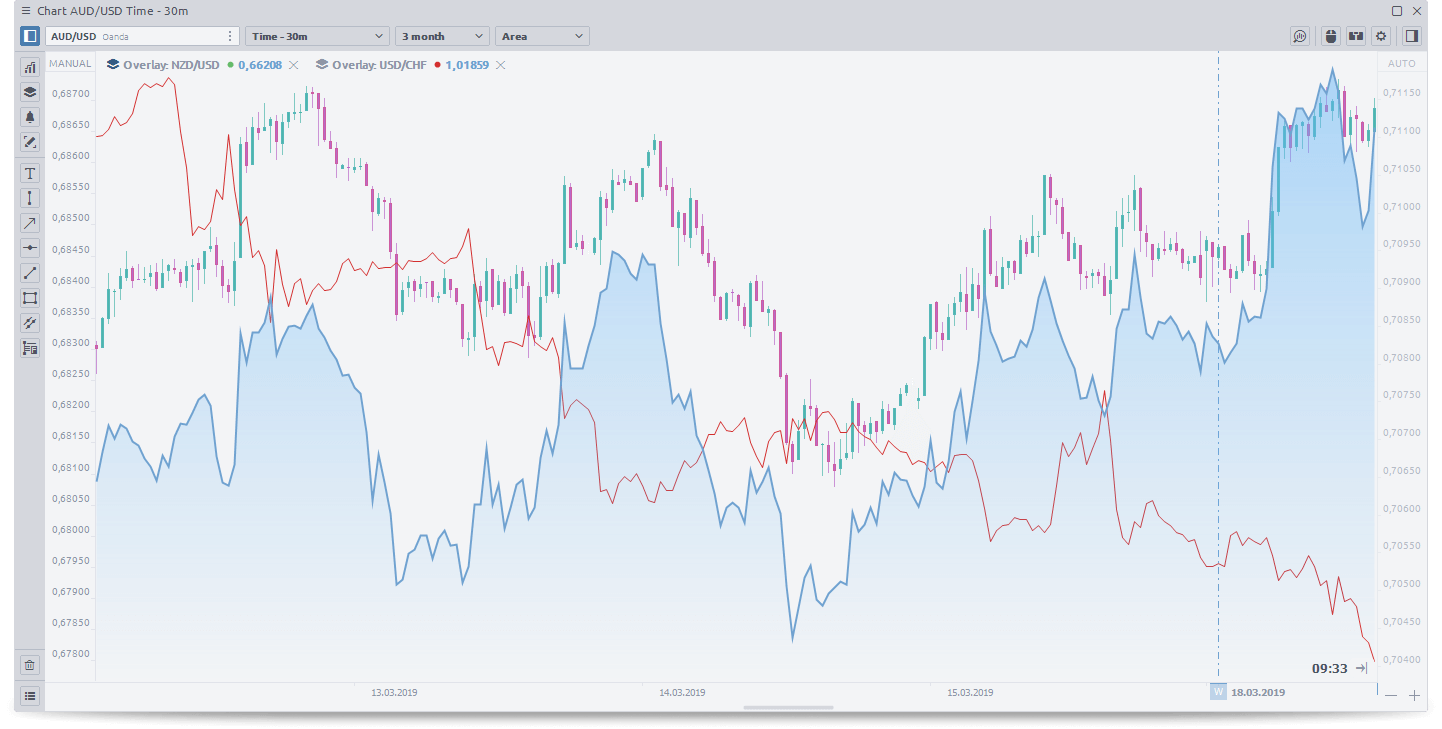

Chart overlays

Add and compare several assets on the same chart to find out their relationship with each other. Use absolute price scales to see how each instrument has performed since the start of the year.

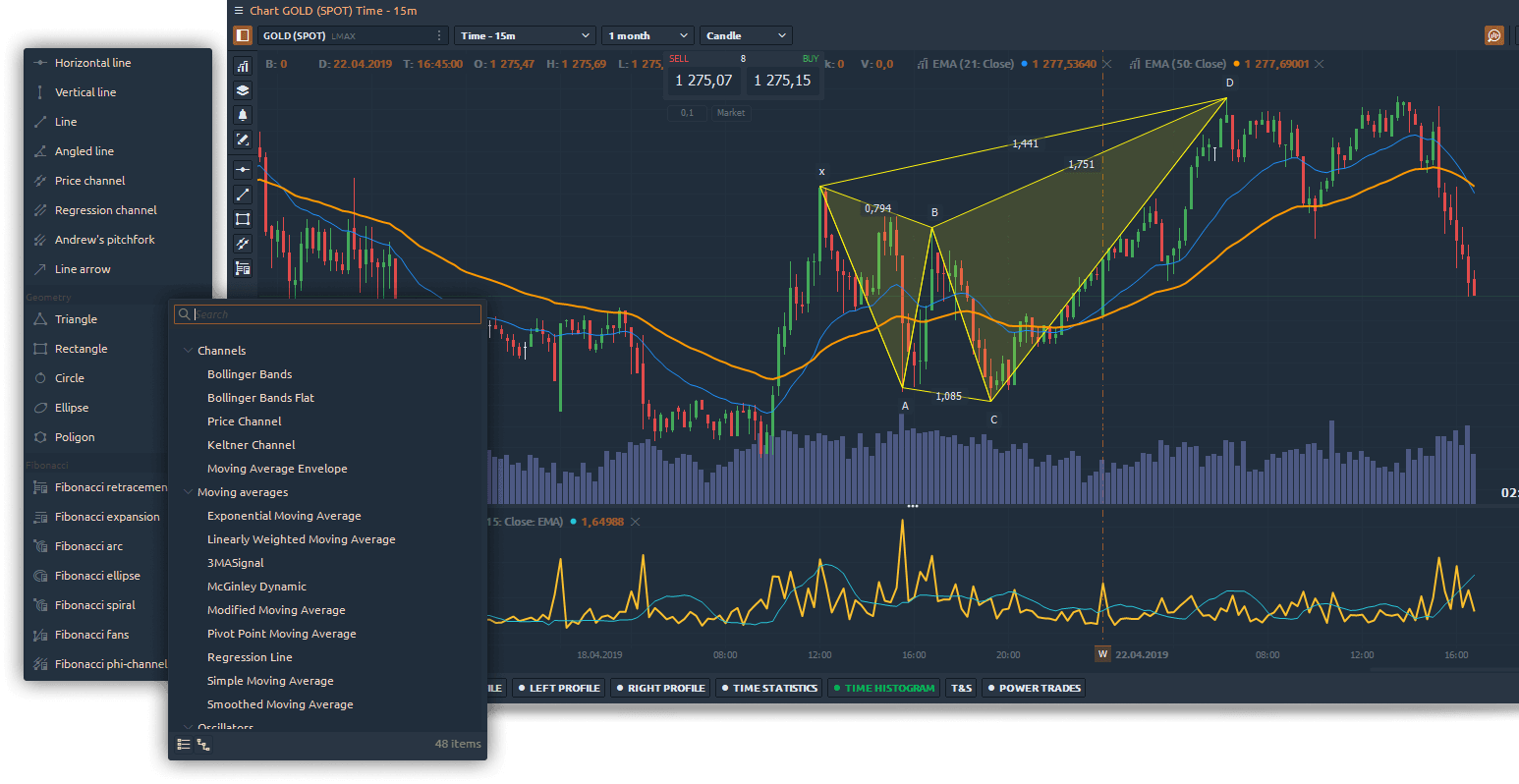

Drawings and Indicators

Wide list of drawing tools and indicators are ideal for technical traders to analyze volatility, support & resistance, trends, as well as reversal points.

- Trends & Channels

- Geometry tools

- Fibonacci & Gann

- Harmonic patterns

- Text & Comments

- Channels

- Moving Averages

- Trends Volatility

- Volume

- Oscillators

More features to explore

Quantower offers connectivity to over 60 brokers, exchanges, and data feeds, providing traders with access to multiple asset classes and trading symbols. Our platform also allows for simultaneous connections and the creation of spreads and synthetic symbols.

Quantower offers a seamless trading experience, with fast and accurate order execution, transparency, security, and flexible order execution options. You can rely on our platform to provide you with the features you need to execute your trades efficiently and effectively

Quantower offers several key features for option trading, such as options chains, option Greeks, and option strategies. Our user-friendly interface provides every option trader with the necessary tools to make informed decisions and achieve their trading goals

Quantower provides excellent customization options for its trading interface, including panel binding and grouping, the ability to modify each panel's parameters and display, and the option to save these modifications as templates for future use