Options trading

Options desk

Get extended information about the current prices of Call and Put options with their Greeks, implied volatility and open interest. The industry-standard view of the options desk allows you to display several series at the same time with a custom depth of strikes

Options desk view

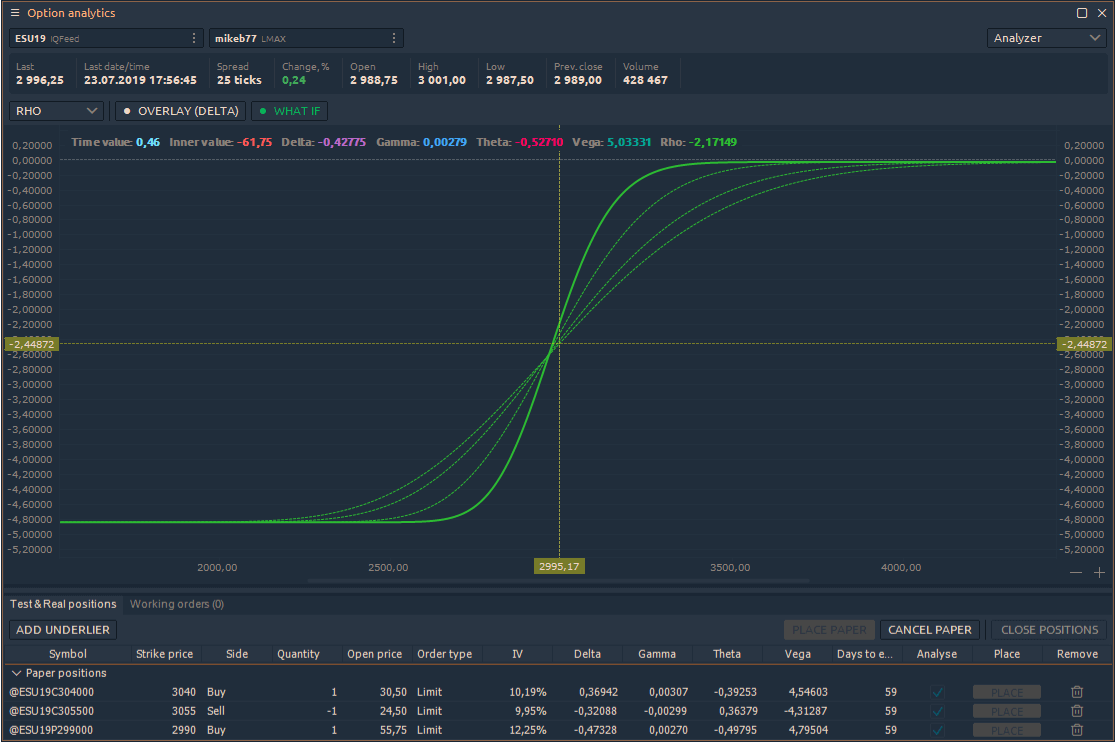

Analyzer view

Options Desk & Analyzer

Options risks analysis

Create and analyze custom, user-defined strategies and submit them to the exchange. Switch between various options “Greeks” risk profiles for advanced analysis

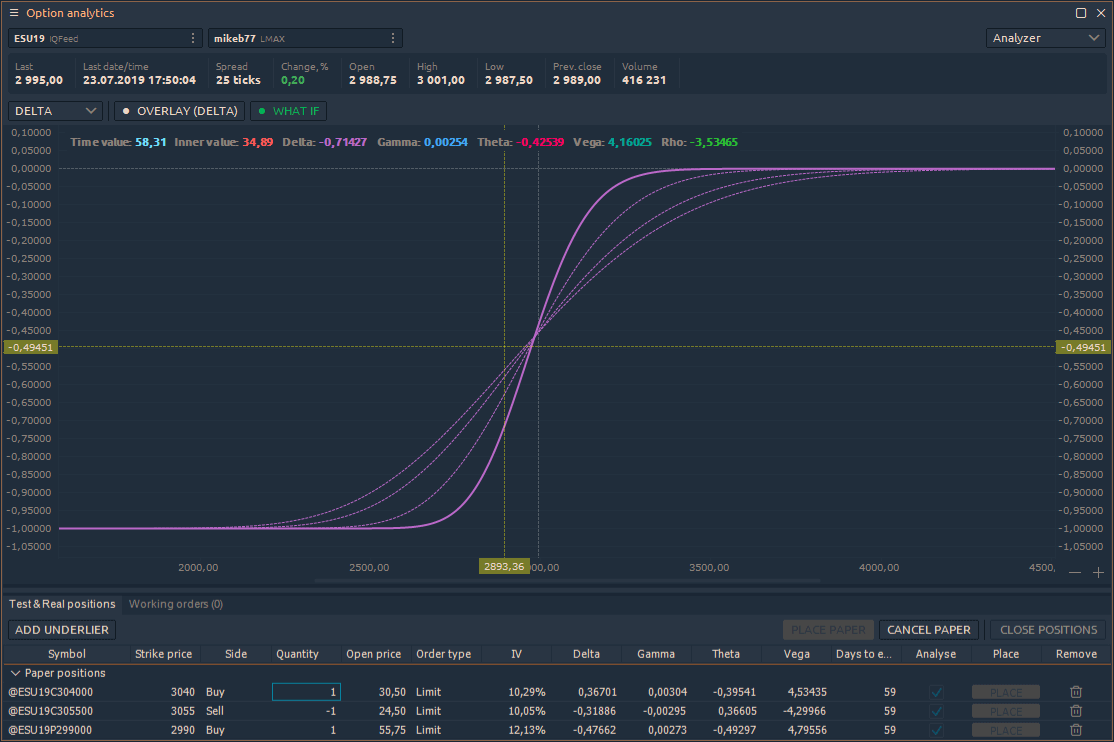

Delta

Shows change of option price when the Underlier price moves

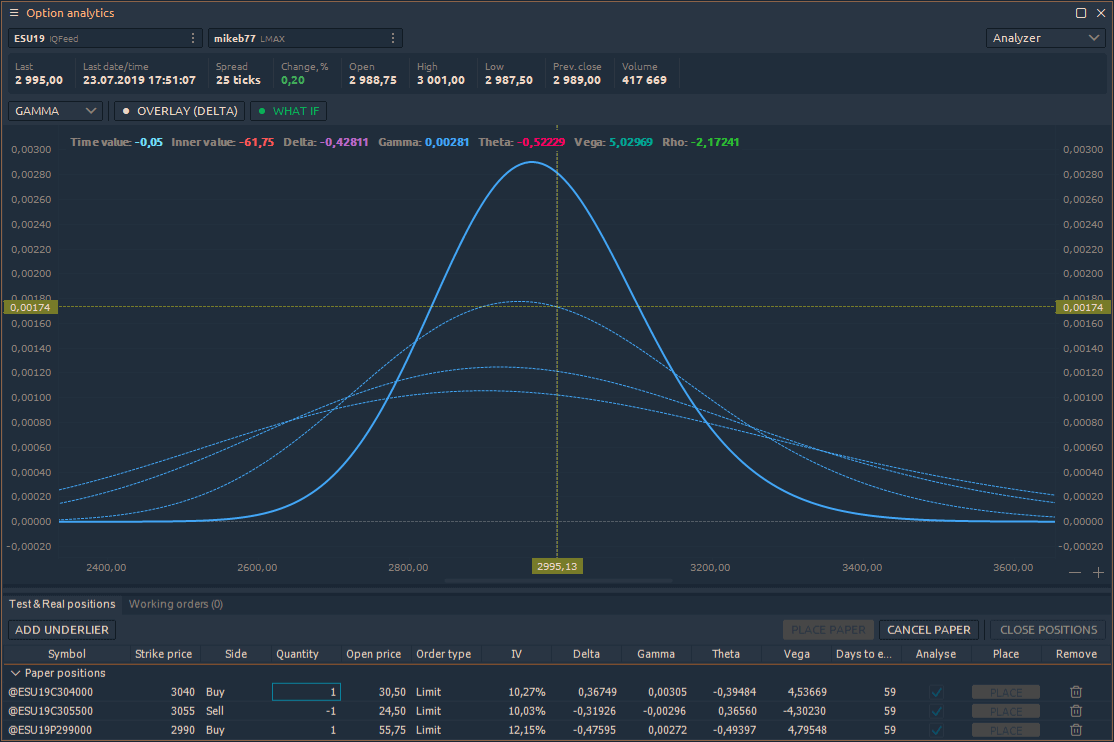

Gamma

Shows change of Delta when the underlier price moves

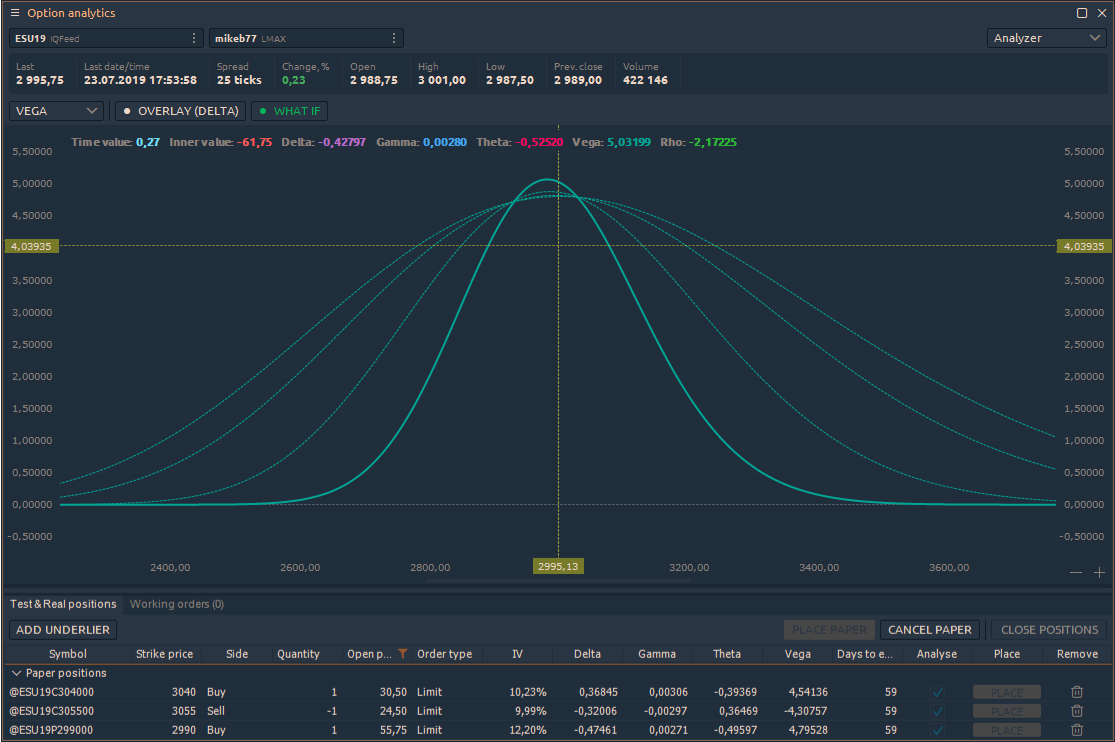

Vega

Shows change of option price when Volatility moves

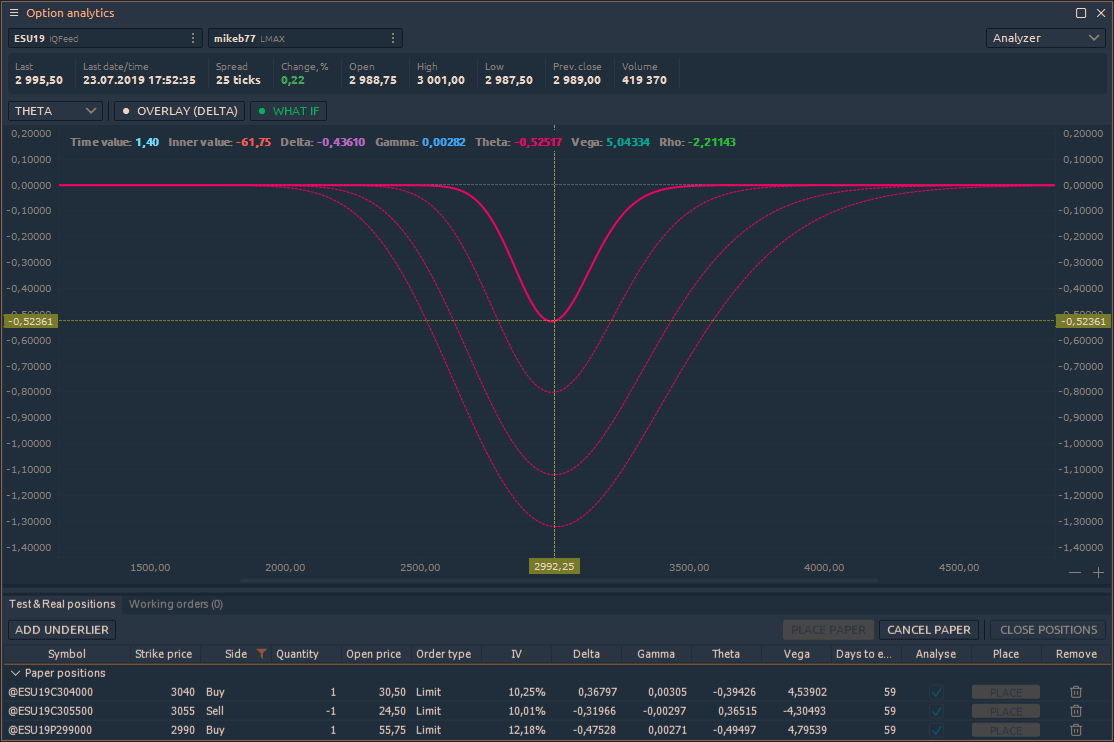

Theta

Shows change of option price Over Time

Rho

Shows change of option price when Interest Rate moves

Feels like the Quantower is what you are looking for?

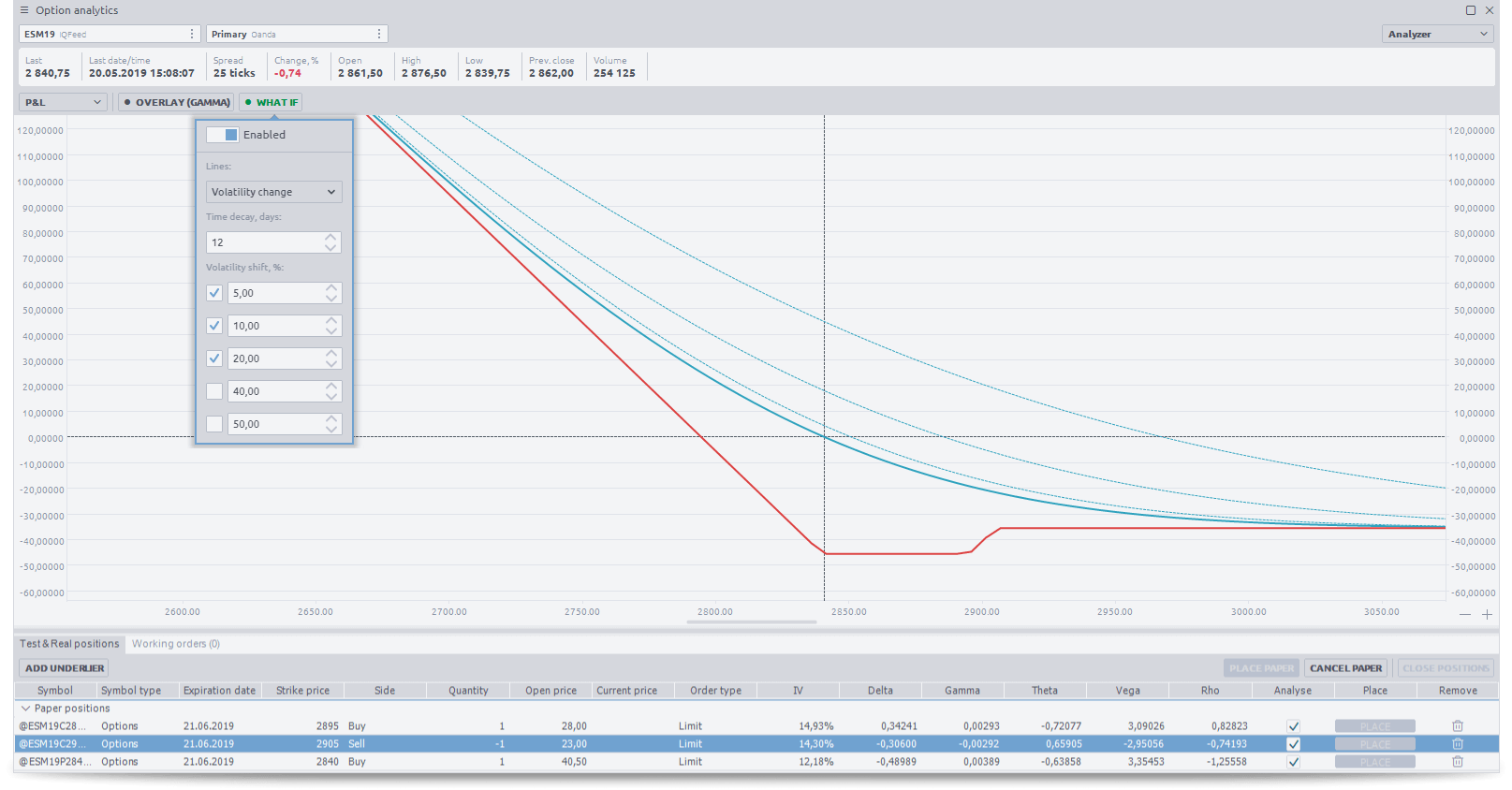

What-If scenario

Assess the impact of volatility and time decay on the selected options strategy by using What-If analysis. Add up to 5 lines simultaneously on the payoff chart to evaluate “profit if close” profile.

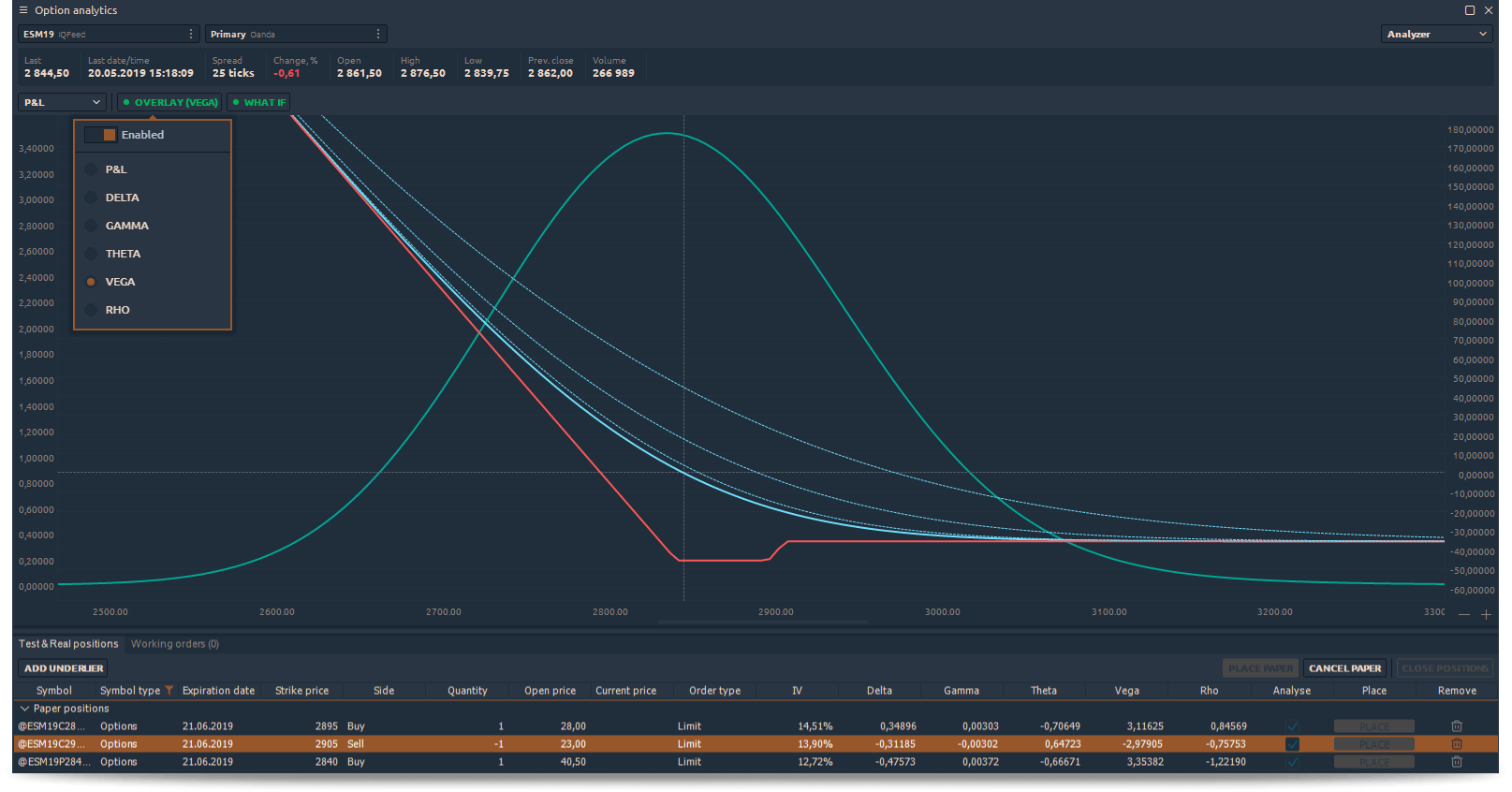

Profile overlays

Add Greek curves to the options profile chart to analyze your position in detail

More features to explore

Quantower offers connectivity to over 60 brokers, exchanges, and data feeds, providing traders with access to multiple asset classes and trading symbols. Our platform also allows for simultaneous connections and the creation of spreads and synthetic symbols.

We offer a comprehensive range of charting tools that provide traders with the flexibility to choose from a variety of timeframes, a multitude of technical indicators, drawing tools, a wide range of chart types, and exceptional customization options to suit their trading strategies.

Quantower offers a seamless trading experience, with fast and accurate order execution, transparency, security, and flexible order execution options. You can rely on our platform to provide you with the features you need to execute your trades efficiently and effectively

Quantower provides excellent customization options for its trading interface, including panel binding and grouping, the ability to modify each panel's parameters and display, and the option to save these modifications as templates for future use